XLCS Partners Announces Recent Promotions

XLCS Partners, Inc., a leading middle market investment bank, is pleased to announce recent promotions at the firm.

Johnny Sebastian, Reed McMahon, David Silva, and Noah Shertzer have all been promoted to Associates. Matt Crabtree has been promoted to Senior Associate, and Eric Schoendorf has been promoted to Vice President.

“We are thrilled to recognize the personal and professional development of our team with these well-deserved promotions,” said Bob Contaldo, Managing Partner. “They have all demonstrated a commitment to excellence, and we are confident that they will continue to play a significant role in the growth and success of our firm.”

XLCS is currently seeking senior level investment banking professionals nationwide and is looking to fill analyst, associate, VP, marketing, finance, and administrative positions. Please visit https://xlcspartners.com/careers/ for more information.

About XLCS Partners, Inc.

XLCS Partners is an investment banking firm providing M&A advisory services to select clients globally. More information is available at www.xlcspartners.com.

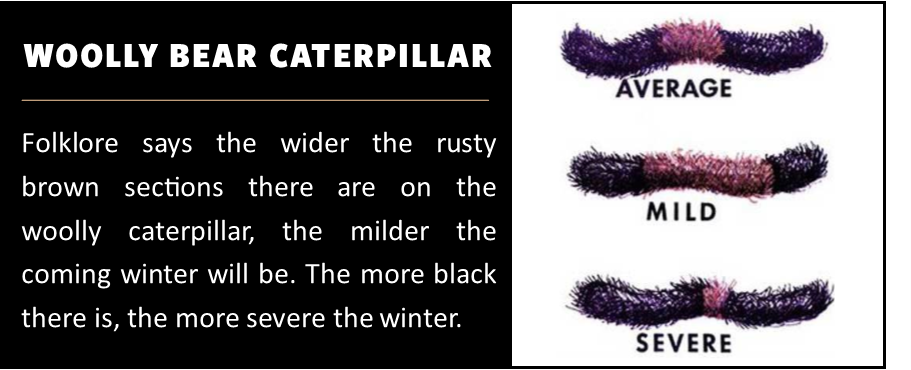

It’s sunny, hot, and humid. Summer yes, but there are telltale signs that a change is in the air. Cooler misty mornings, ever so subtle color change in the leaves of some trees, tiny acorns dropping, and a few more leaves on the ground. It’s still 84 degrees, but not the same overall feel of 84 degrees in June. The air is just a little different. The overall look and feel just a little different.

It’s sunny, hot, and humid. Summer yes, but there are telltale signs that a change is in the air. Cooler misty mornings, ever so subtle color change in the leaves of some trees, tiny acorns dropping, and a few more leaves on the ground. It’s still 84 degrees, but not the same overall feel of 84 degrees in June. The air is just a little different. The overall look and feel just a little different.

Recent Comments